It is critical to address the climate finance issues affecting the countries of the Caribbean and the Americas now..

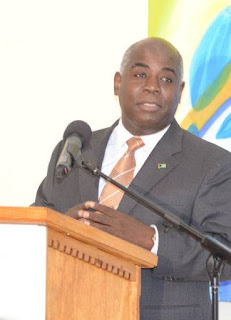

The Bahamas Prime Minister, Philip Davis’ Remarks at the Climate Finance in The Americas Meeting’s Opening Session

OCTOBER 2, 2023

"...let’s not forget that climate finance is ultimately about people, not just numbers on a balance sheet. It’s about protecting our planet, our communities, and current and future generations from the devastating impacts of climate change. And, it’s about building a more equitable and inclusive future for everyone, not just the privileged few."

Dear Friends and colleagues, let’s get right to the point.Everyone in this room is aware of the urgent need to mobilize trillions of dollars in investment to tackle the climate crisis. We’ve made some progress in recent years, but we still have a long way to go.

So how do we get there? What do we need to do, starting right now, to mobilize those trillions of dollars? And how can we work together to make that happen?

From shifting investor preferences to reforming multilateral development banks to tackling currency risks, there are many factors that will determine our success in this endeavor.

But before we dive into the details, let’s take a step back and consider why climate finance matters.

Put simply, we cannot achieve our climate goals without it. This is true for the developed world, but it is especially true for developing nations. Whether we are talking about transitioning to renewable energy, improving energy efficiency, or protecting vulnerable communities from the impacts of climate change, all of these efforts require significant investment.

We hear again and again that meeting the climate change challenge is costly. Something is costly when it does not contribute to the goals we set ourselves, as individuals or as societies.

Climate finance, though, is ultimately about what we, as societies, value; the world we want to live in and the lives and hardships we can save by channeling our money to build resilience against the ravages of climate change.

We need to reform the international financial architecture, including private finance flows and multilateral development banks.

We need to make the current international financial architecture fit for purpose to enable low emissions and climate-resilient investment globally, in every region and in every country.

At COP27, Parties called for a transformation of the financial system and its structures and processes, engaging governments, central banks, commercial banks, institutional investors and other financial actors. They also called for significant reforms of multilateral financial institutions in terms of financing models, risk appetites, and non-debt instruments.

We’re also seeing new initiatives from the financial sector that highlight the need for scaled-up climate finance. We’re seeing central banks form coalitions and networks; we’re seeing financial institutions make net-zero pledges; and we’re seeing a growing number of country investment platforms and just energy transition partnerships.

Additionally, a growing number of complementary efforts on reform are in motion, including through the G20, V20, the IMF and other regional forums.

The number of initiatives alone shows how the reform imperative has garnered increasing momentum, but at the same time, how it has fragmented into disparate efforts. This reality reinforces more than ever the importance of coordination to ensure the whole is greater than the sum of its parts.

Reforms must respond to the need to drive progress across three main areas.

First, we need to drive progress on managing risks to investing in climate action in developing countries. Where risk is real, we need to deploy at scale the risk reduction instruments – such as guarantees, insurance, and local currency hedging and financing – necessary to unlock capital. Where risk is perceived, we need to address the biases that hinder investment at scale, and the expectation of high financial returns when engaging on climate change.

Second, we need to drive progress on financing a just and equitable transition. We need to develop transparent transition plans that shift investment portfolios over time, and that enable ramp-ups in climate investments to the same extent as we see a phasing out of harmful investments.

Third, we need to drive progress on managing the debt crisis. We need to develop a shared understanding of climate-fiscal-debt links and ensure no country builds up excessive debt because of climate action.

My friends, let’s be candid. The clock is ticking. We needed change and action years ago. But now we’re really running out of time.

The Bahamas is an archipelago of 700 islands and numerous cays, spanning thousands of square miles.

Our location means we are highly susceptible each year and in some cases multiple times per year to hurricanes, floods, and rising seas.

When a hurricane devastates the economies of multiple islands at a time, as was the case with Hurricane Matthew, Hurricane Joaquin and more recently Hurricane Dorian, we are left with the daunting task of rebuilding each island’s economy, including rebuilding communities, and damaged infrastructure such as communication networks, water supply, school systems, airports and ports.

It takes us years to recover – and consider this – in under ten years, we have been hit by four separate Category 4 or Category 5 storms.

This traps us in a vicious cycle:

- We are vulnerable to a warming climate caused by the emissions of other nations;

- Hurricanes made more intense by that warming climate leave behind extreme devastation and a loss of economic activity;

- We are forced to borrow to repair and rebuild, at high-interest rates which reflects our climate vulnerability and our lack of fiscal space to invest in resilience;

And on and on it goes.

In the meantime, our country is considered a high-income country, limiting our access to concessional financing and development aid.

This is an old formula that makes no sense in a new era. And this is no inconsequential technicality – the high-income designation means we cannot sufficiently invest in our people, our development, and our resilience.

This has to change.

It is critical to address the climate finance issues affecting the countries of the Caribbean and the Americas now. Our calls for action are strongly articulated in the Declaration of The Bahamas on Climate Finance in The Americas. This Declaration was negotiated and formally agreed to by OAS member states, and reflects our joint call for global and hemispheric change to the climate finance architecture.

The Declaration of The Bahamas on Climate Finance in The Americas highlights the four key pillars of climate finance:

1 - Enhancing Access through strengthened efforts and collaboration to expand adequate, and direct access to climate finance at scale for all developing countries in the Americas. This pillar, among other things, also emphasizes the call to move ‘beyond GDP per capita’ to capture climate vulnerabilities in funding decisions in a manner that supports climate-vulnerable countries.

2 - Improving the Terms and Instruments of Finance

Under this pillar, member states stressed the fundamental role of concessional and non-debt finance for the provision and mobilization of resources for assisting developing countries in the Americas in combating climate change. We also call for enhanced efforts and collaboration to expand affordability of climate finance in the Americas.

3 - Scaling up Towards Adequacy

Here, we jointly call on the Multilateral Development Banks to boost efforts and collaboration to scale up the provision and mobilization of adequate climate finance in the Americas.

4 - Improving Coordination

Under this final pillar, our countries call for enhanced efforts and collaboration by improving accountability and coordination in respect to climate finance. We call on the Multilateral Development Banks to collaborate with regional and national development banks, as well as United Nations agencies, the OAS, CARICOM, hemispheric and regional intergovernmental organizations and philanthropies, to improve governance and coherence, efficiency and effectiveness of climate finance architecture. We also call on member states to take steps to advance the calls in this Declaration in relevant fora.

Friends and colleagues, this brings me to my final point: using the global stocktake and the new collective quantified goal on climate finance as pivotal moments to set reforms in motion.

The global stocktake is a process for countries and stakeholders to see where they’re collectively making progress towards meeting the goals of the Paris Agreement – and where they’re not.

It’s like taking inventory. It means looking at everything related to where the world stands on climate action and support, identifying the gaps, and working together to chart a better course forward to accelerate climate action.

The stocktake is a course-correcting moment, an opportunity to provide a roadmap with ‘solutions pathways’ that drive immediate action.

Some of the key finance pathways could include fostering accountability of non-state actor commitments, and innovative financing models to tackle currency risks.

This is the year we need to establish clarity on how governments, multilateral development banks and international financial institutions, private sector finance institutions and industries will deliver the trillions required.

I emphasize again the urgent need for action on climate finance, and the importance of collaboration and innovation in addressing this complex challenge.

But let’s not forget that climate finance is ultimately about people, not just numbers on a balance sheet.

It’s about protecting our planet, our communities, and current and future generations from the devastating impacts of climate change.

And, it’s about building a more equitable and inclusive future for everyone, not just the privileged few.

I can’t think of more important work. So let’s keep pushing forward together with determination and purpose.

Thank you very much.

Source